Individual Retirement Accounts

October 1, 2021Individual retirement accounts (IRAs) can look intimidating and cryptic when you begin planning for retirement, but there are some foundational lessons to learn so you plan wisely.

Roth vs Traditional

There are two types of IRAs: a traditional IRA and the Roth IRA. The main difference between them is when you pay taxes.

A traditional IRA is tax deferred. This means that can contribute money before it’s taxed, and you don’t owe taxes on those contributions or your earnings until you withdraw the money. It’s likely that you will be earning less when you begin to withdraw from your IRA, which means that you may end up being in a lower tax bracket and paying less overall in taxes. If you qualify, you may also be able to deduct your contributions to your IRA on your federal income tax return, which can lower how much you will need to pay.

A Roth IRA is not tax deferred, which means you owe taxes when you contribute the money to the account. But that means you won’t have to worry about paying them later and your contribution can grow tax-free. Withdrawals of contributions and earnings are tax-free if your account has been open at least five years, and you’re at least 59 and a half.

Which IRA is for You?

When deciding which option is right for you, there are a few things to consider. Perhaps most importantly, is what you qualify for. You’ll need to qualify for a Roth IRA based on your modified adjusted gross income (MAGI), and you’ll also need to qualify in order to deduct your contributions to a traditional IRA from your federal tax return.

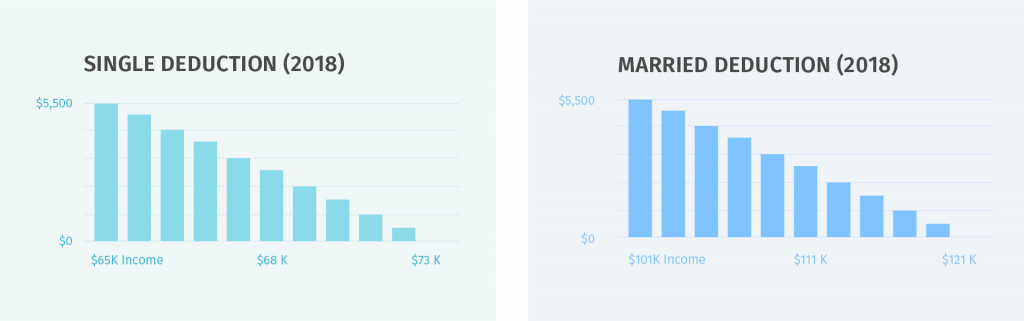

The income limits are stricter for deducting your contribution to a traditional IRA than for contributing to a Roth IRA. In 2021, for example, you can deduct all of your IRA contributions if you’re single, and you either don’t have a retirement plan where you work or your MAGI is less than $63,000. You can deduct a gradually decreasing portion of your contribution as your income gets closer to $73,000 and nothing if it’s above $73,000. You can always deduct the full amount of your contribution if you’re not eligible for a retirement plan at your job or your employer doesn’t offer one.

You’re eligible for a full Roth contribution in 2021 if you’re single and your AGI is less than $120,000. With an AGI between that amount and $135,000, you can put a gradually declining portion of your contribution into a Roth and the balance into a traditional IRA if you wish.

For a married couple filing a joint return, the income limits for a deductible traditional IRA begin at $104,000, and are phased out at $124,000 for 2021. Either of you can deduct your contribution if you have no retirement plan of your own at work or aren’t eligible. But if your spouse has a plan, the amount you can deduct is reduced gradually if your joint modified adjusted gross income is over $196,000 in 2021, and eliminated if it’s over $206,000. Each of you qualifies to contribute the full $6,000 to a Roth IRA if your joint MAGI is $196,000 or less in 2021 and smaller amounts until it reaches $206,000 when your eligibility is phased out.

Withdrawing the Money

If you want to make a withdrawal before you’re 59 and a half, you’ll have to pay a 10% tax penalty. On the other hand, you must begin to take required minimum distributions (RMDs) after you turn 70 and a half (or 72 if you were born after June 30, 1949) if you have a traditional IRA. This is a minimum amount that you’re required to withdraw each year. RMDs are taxed as ordinary income. If you have a Roth IRA, you won’t have an RMD.

Contribution Limits

The only requirement for opening an IRA is having earned income—money you get for work you do. Your total annual contribution is limited to $6,000 for 2021, whether you put it all in one account or divide it between a traditional IRA and a Roth. If you’re 50 or older, you can add an annual catch-up contribution of $1,000. You’re eligible whether you’ve contributed to an IRA in the past or not.

Any amount you earn qualifies, and you can contribute as much as you want, up to the annual cap. But you can’t contribute more than you earn. For example, if you earn $1,800 in a year, that’s how much you can put in. And whether you earn $5,500 or $350,000, the top limit is the same.

Spousal Accounts

If your husband or wife doesn’t work, but you do, you can contribute up to $6,000 for 2021 to a separate spousal account in your spouse’s name. The advantage for the nonworking partner is being able to build an individual retirement fund that he or she owns and controls.

It’s Your Account

It’s easy to open an IRA. All you do is fill out a relatively simple application provided by the bank, mutual fund company, brokerage firm, or other financial institution you choose to be custodian of your account.

Because IRAs are self directed, which means you decide how to invest the money, you’re responsible for following the rules that govern the accounts. Basically, that means putting in only the amount you’re entitled to each year and making approved investments. You must also report your annual contribution to a traditional IRA to the IRS, on Form 1040 or 1040A if it’s deductible and on Form 8606 if it’s not.

You can invest your IRA money almost any way you like that’s available through your custodian, from putting it in savings accounts to buying volatile options on futures. The things you can’t choose are fine art, gems, non-US coins, and collectibles. You can buy and sell investments within your IRA and reinvest the money whenever you please without worrying about paying tax on any gains. But you may pay sales charges and other fees on those transactions.

When to Contribute

You have until April 15—the day tax returns are due—to open an IRA and make the deposit for the previous tax year. If April 15 falls on a Saturday or Sunday, your deposit is due by Monday, April 16 or 17, or sometimes as late as April 18.

You can put money into your IRA in a lump sum, or spread your contribution out over up to 15 months. You may put in the whole amount the first day you can, January 1 of the tax year you’re making the contribution for. Or, if you’re like most people, you’re more apt to make the deposit on the last possible day, which is April 15 for the previous tax year.

The most practical solution may be weekly or monthly contributions, perhaps as direct debits or electronic transfers from your checking account. There are no guarantees when you invest this way, any more than there are when you invest a lump sum. You could lose money, especially in the short term. But if your investments do well, adding to them regularly can give your account value a real boost. And the longer money is invested, the more it has the potential to grow.

This article has been republished with permission. View the original article: Individual Retirement Accounts.