Mobile Banking Explained

October 4, 2021Mobile banking provides a convenient, safe way to access your funds when you’re unable to visit a branch.

What is Mobile Banking?

Mobile banking is using an app or website to access your accounts and perform transactions. It’s a service provided by a financial institution and is usually available around the clock.

Almost every bank and credit union has some kind of internet banking solution such as a website, app, or, most often, both. These solutions are shockingly robust. While the face-to-face experience at your bank or credit union is most likely unmatched, mobile banking can offer many of the same or similar services. Common services include viewing your account balances, making transfers, paying on loans, and depositing checks.

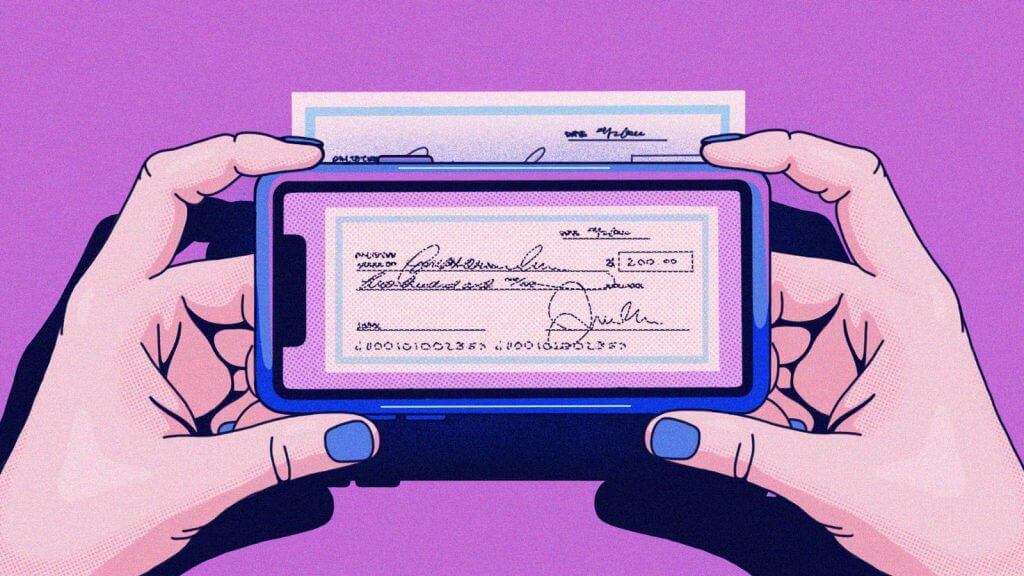

Mobile Deposits

One potential service available through mobile banking is the ability to deposit checks remotely; this is called a mobile deposit. Though cash deposits have to be made at the branch, you can often deposit checks into your account with your mobile device. Financial institutions use remote deposit capture to make this happen—just snap pictures of the front and back of a signed paper check through the app and, if approved, the money will be added to your account without you ever having to step out your front door. Remote deposit is convenient and easy, but follow the instructions in the app carefully and hang onto the check for a few weeks just in case there’s a problem with the deposit.

Transfers and Loan Payments

Through many mobile banking apps, you can quickly and securely transfer money between accounts. This means, for example, you can pull money from a savings account and put it into a checking account with just a few buttons. If you have a home, auto, or personal loan through the same bank or credit union as your checking or savings account, you can easily make payments remotely by transferring money from these accounts to the loan directly.

View Your Statement

Mobile banking often allows you to view statements right on your device. You can open a statement to quickly access your account number or balance your checkbook. Often, you can download the statement if you need to print it or use it to apply for a loan.

Safety and Security

Banks and credit unions work tirelessly to keep their internet banking options as safe and secure as possible. Many apps and websites will use two-factor authentication and others will use fingerprint or face scans to ensure that only you can access your accounts.

Another key aspect of cybersecurity in mobile banking comes from encrypting data. This means that a secure system makes it extremely difficult for a hacker to access the data transmitted through wifi or radio waves as well as any stored data.

Of course, you should also take steps to keep your account secure by using a unique password and only accessing mobile banking on secure networks. If you have any questions, talk to your bank or credit union for their recommendations on how to best protect yourself when using mobile banking options.

Mobile banking is a powerful tool that makes managing your finances easier and more convenient. If you don’t know what your financial institution offers, give them a call or check their website.

This article has been republished with permission. View the original article: Mobile Banking.