Social Security Basics

October 1, 2021Since its introduction in the wake of the Great Depression, Social Security has evolved from a safety net designed to relieve poverty to the mainstay of a secure retirement.

What You Contribute

If you’re in the Social Security system—and more than 96% of the workforce is—you usually contribute 7.65% of your salary every year, 6.2% for retirement and disability benefits and 1.45% for Medicare coverage. Your employer contributes an equal amount, and if you’re self-employed you pay both shares. There’s an annual cap on contributions for retirement and disability but no cap on Medicare contributions.

Figuring the Benefits

The formula the Social Security Administration (SSA) uses to calculate your primary insurance amount (PIA)—the base on which your benefit is figured—is designed to give you credit for your 35 highest paying years, thereby increasing the amount you’ll receive.

Here’s how it works:

- Your lifetime earnings (to age 60) are adjusted for inflation, so they’re counted at their current value.

- Your total earnings are divided by the number of months you worked, to find what’s known as your average indexed monthly earnings.

- Your permanent base benefit is figured on your average indexed monthly earnings.

Looking at the Numbers

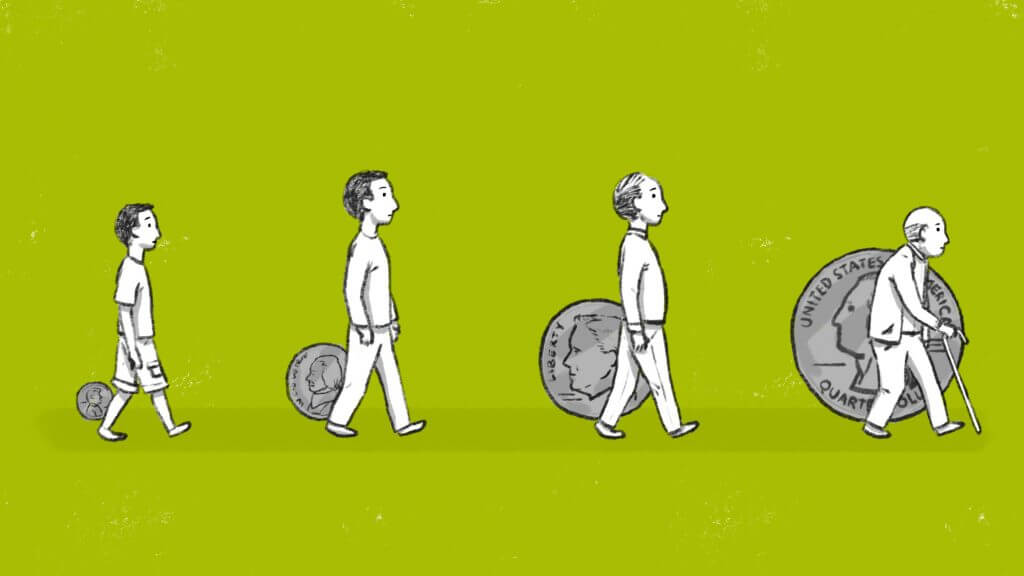

According to recent statistics, there are three people working—and putting money into the system—for every retired person. That’s a far cry from 1950, when there were 16 workers for every retired person. By 2030, estimates are that the number will decrease to two workers for every retired person.

How You Qualify

You qualify for Social Security benefits in two steps:

- You contribute to the Social Security system, usually with money your employer withholds from your salary

- You accumulate 40 credits during the years you work. You can get up to four credits a year, one for each time you earn the minimum required for that year.

In 2021, you receive one credit for each $1,470 of earnings. Each year the amount needed for credits goes up slightly as average earnings increase. You can only earn up to four credits per year.

So a person who earns $10,000 a year and a person who earns $100,000 a year each accumulates four credits. If you work full time, you’ll be fully qualified in ten years, but you’ll also qualify if you gain the credits more sporadically.

The benefits you receive depend more on the amount you contribute to the system and how old you are when you begin taking benefits than on simply accumulating the credits to qualify.

Where You Stand

You can start collecting Social Security benefits as early as 62 or as late as you wish, though there is no point in waiting past 70 since the base amount you’re eligible for won’t increase any more.

As soon as you turn 62, you may begin taking out a percentage of your social security benefits, but you won’t be eligible for the full amount until you reach FRA (full retirement age). If you take benefits out early the amount that you will be eligible for when you reach FRA will be reduced.

Your FRA is determined by the year you were born. For those born between 1943 and 1954, it’s 66. From there, it gradually increases. For those born in 1955, it’s 66 and 2 months, for those born in 1956, it’s 66 and 4 months, all the way up until those born in 1960 or later, for which it is 67. For each of the years you wait past your FRA and before you turn 70, your benefit goes up. Check out this table to see more specifics.

You can estimate your Social Security income at any age by going to ssa.gov/estimator and following the directions.

You Have to Apply

You don’t get your benefits automatically. You have to apply to the SSA, and the time to begin is in the year before you plan to retire or take benefits. One reason to plan ahead is that you may be able to adjust your start date and increase the overall amount of your benefits.

Taxes on Benefits

You may have to pay tax on part of your Social Security benefits, reducing the amount you’ll have available to live on. That happens when your total income for the year, including half your Social Security payment, is more than the levels set by Congress.

What’s perhaps surprising is that you might find yourself in this situation even if your income seems modest. That’s because the income limits are relatively low and practically all of your income is counted, even earnings on tax-exempt investments.

If you’re single and your income is between $25,000 and $34,000, you must include 50% of your benefit in your taxable income, and if your income is over $34,000, you must include 85%.

If you’re married and filing a joint return, the income levels are slightly higher. If your income is between $32,000 and $44,000, you must include 50% of your benefit in your taxable income. If it’s over $44,000, you must include 85%. If you’re married but file separate returns, you must always include 85% of your benefit in your taxable income, regardless of income.

Uncertain Future

While social security has been around for nearly a decade, its future is uncertain. Fewer workers will be putting money into the system in the 21st century while more will be collecting benefits. What this will mean for the future of the current generation of workers is unclear, but it’s likely that some type of change will have to occur in order for social security to continue as we know it today.

This article has been republished with permission. View the original article: Social Security Basics.